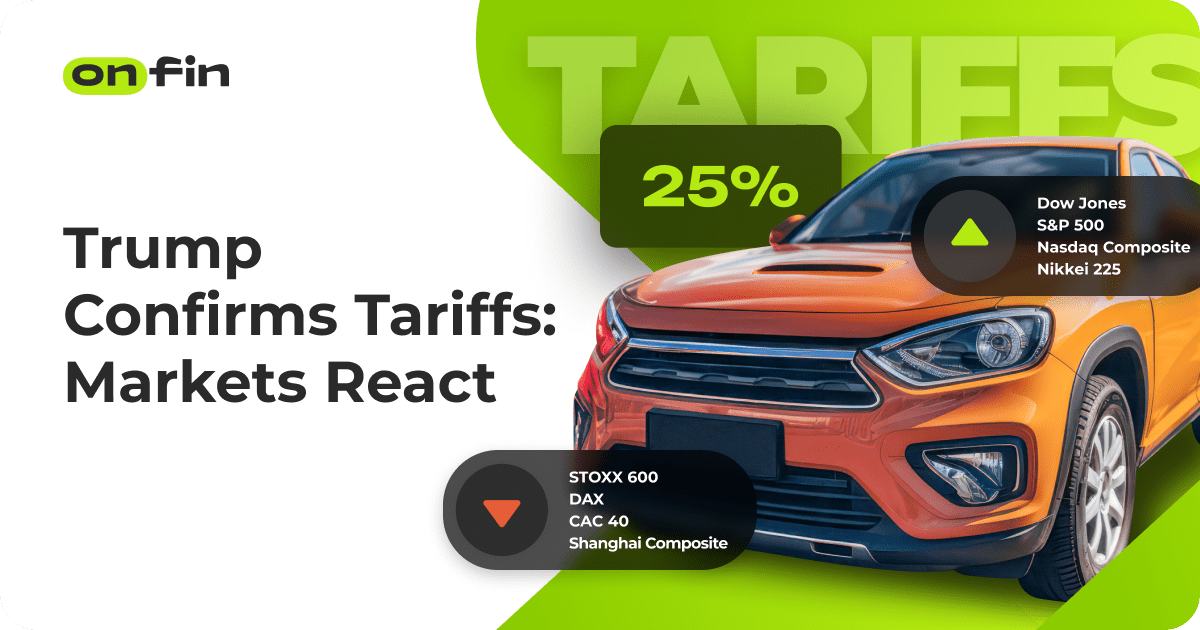

On April 2, U.S. President Donald Trump officially confirmed the implementation of new trade tariffs. According to The Guardian, Trump announced the immediate introduction of 25% tariffs on imported vehicles from foreign automakers.

Additionally, CNN reported that Trump plans to impose at least a 10% tariff on all imported goods. Higher tariffs will be applied to countries that have the largest trade deficits with the United States. According to official data, China, Mexico, and Germany currently have the largest trade deficits with the U.S.

Starting April 9, reciprocal tariffs will take effect for approximately 60 countries that imposed tariffs on American goods. The list includes major economies such as China, India, and several European Union member states. The U.S. administration stated these retaliatory tariffs would apply specifically to products previously targeted by those nations.

Trump’s announcement occurred after the closure of U.S. stock markets. Prior to the announcement, key U.S. indices showed gains in anticipation of the tariff news. The Dow Jones Industrial Average increased by approximately 0.65%, while the S&P 500 rose around 0.87%. The Nasdaq Composite closed higher as well, adding about 0.56% for the trading session.

By contrast, European stock markets experienced losses on the same day. The pan-European STOXX 600 index ended down 0.5%, impacted negatively by ongoing uncertainty about international trade relations. Germany’s DAX index dropped approximately 0.7%, while France’s CAC 40 index closed about 0.4% lower.

Asian stock markets also exhibited mixed performances leading up to Trump’s tariff announcement. Japan’s Nikkei 225 slightly increased by about 0.3%, whereas China’s Shanghai Composite index declined by around 0.4%. Hong Kong’s Hang Seng Index recorded minimal changes, ending the session almost flat.

In commodities markets, gold prices rose modestly on the news, increasing approximately 0.6% to trade near recent highs. Spot gold prices reached approximately $3,025 per troy ounce by market close, continuing their recent upward trend. Silver prices also climbed slightly, up roughly 0.4% for the trading day.

The U.S. dollar experienced minor fluctuations against other major currencies. The dollar index, tracking the currency against a basket of global currencies, closed virtually unchanged. However, the euro weakened slightly, falling about 0.2% against the U.S. dollar. The British pound maintained stability against the dollar, closing virtually unchanged.

Britain previously announced that it does not intend to immediately respond to the new U.S. tariffs with countermeasures. According to a statement reported by Reuters, the British government plans to carefully analyze the situation before making any decisions.

Canada expressed concern over the announced tariffs on automotive imports. Canadian officials stated they intend to hold bilateral talks with U.S. representatives to seek possible exemptions. Canada is among the largest exporters of vehicles and automotive parts to the United States.

Mexico, another major automotive exporter to the U.S., has indicated it is preparing countermeasures against the new tariffs. Mexican officials announced potential reciprocal tariffs targeting U.S. agricultural exports and consumer products.

European Union officials expressed significant disappointment over Trump’s decision. EU Trade Commissioner Valdis Dombrovskis confirmed the bloc is preparing immediate retaliatory measures targeting U.S. goods, including food, beverages, and consumer electronics.

Germany, home to leading automakers such as Volkswagen, BMW, and Daimler, warned of potential negative impacts on employment within the automotive sector. German Chancellor Olaf Scholz said the German government would support affected industries through potential financial aid and other measures.

Automobile stocks reacted negatively to the news of tariffs. Shares of European carmakers dropped significantly: Volkswagen declined approximately 1.5%, BMW shares fell around 1.7%, and Daimler’s stock price decreased by about 1.4% during European trading hours.

In the United States, shares of domestic automakers initially showed mixed reactions. General Motors shares increased slightly by about 0.3%, while Ford’s stock price remained nearly unchanged. Tesla experienced minor losses, down about 0.2% at market close.

Crude oil prices experienced moderate fluctuations, with Brent crude declining approximately 0.3%, ending around $77 per barrel. West Texas Intermediate (WTI) crude oil prices similarly fell about 0.4%, closing near $72 per barrel.

U.S. Treasury bond markets experienced moderate movements following the tariff announcement. The yield on the benchmark 10-year Treasury note rose slightly, reaching about 3.6% at market close. Shorter-duration bonds saw minor yield increases as well.

Prepared based on materials from The Guardian, CNN, and Reuters.