A Practical Look at Free vs Paid Prop Trading Models

Prop trading firms give traders access to company capital in exchange for a share of profits. Over the past few years, the industry has diversified into different models, each with distinct incentives, costs, and risk structures.

This article reviews five notable prop firms in 2026 and compares their underlying business models. The goal is not to rank firms by quality, but to explain how free investment-based prop models differ from paid challenge-based prop models, and how these differences affect traders.

Let’s get started.

Free vs Paid Prop Trading Models: Which One Is Better?

The real difference between free and paid prop trading models is simple. It all comes down to who takes the risk.

In paid challenge models like FTMO, the risk sits with the trader from day one. Before trading even starts, traders are required to pay an evaluation fee, usually anywhere between $100 and $1,000. This fee is the cost of attempting the challenge.

Prop firms often explain this as a way to filter out non-serious traders. In practice, it also acts as a buffer for the firm. If a trader fails, the fee offsets losses and becomes part of the firm’s revenue. This means the firm gets paid whether the trader succeeds or not.

In free investment-based models like OnFin Prop, that risk shifts back to the firm. Traders are not asked to pay upfront fees to participate. Instead of being judged on whether they can hit a short-term profit target, they are evaluated over time based on consistency and risk management.

Because the firm carries the financial risk, the focus changes. The goal is not to maximize short-term revenue from evaluations, but to identify and work with traders who can perform sustainably.

This naturally leads to stricter evaluation standards and a stronger emphasis on long-term performance rather than quick wins.

With that being said, here are 5 popular examples of different prop-firms that you can start trading with today.

1. FTMO

Paid Challenge-Based Prop Firm

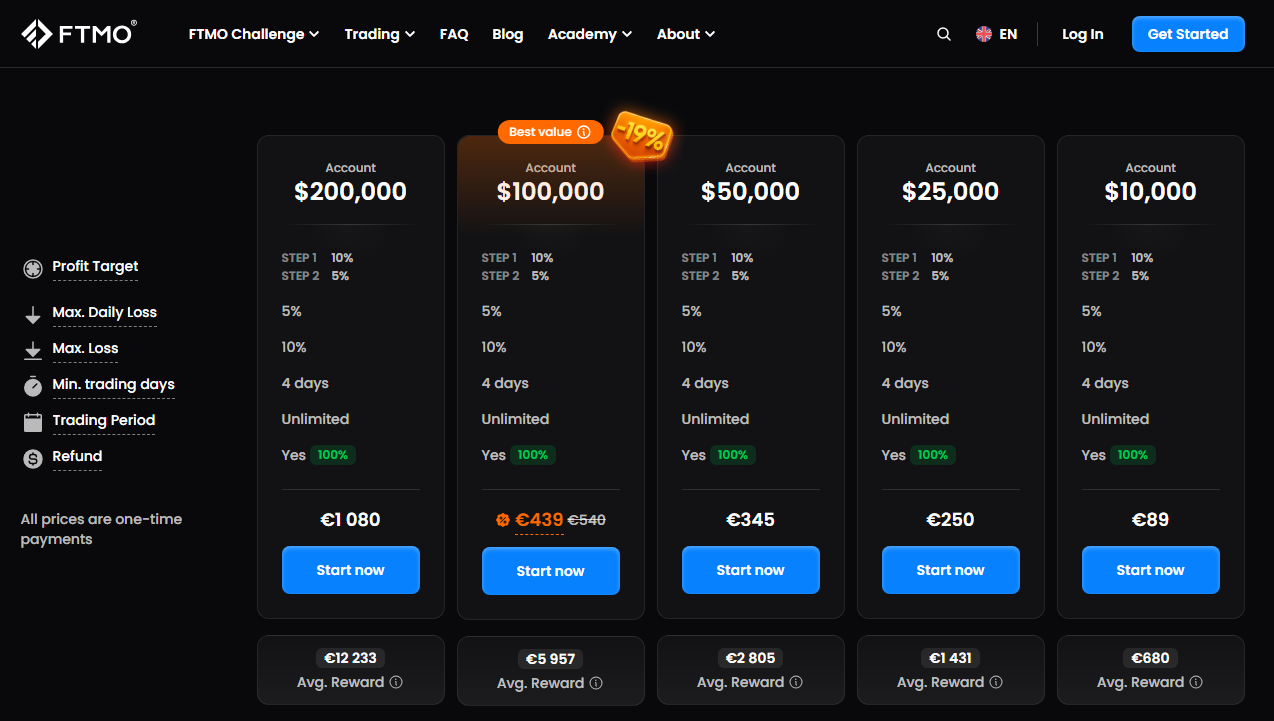

FTMO follows the classic prop firm structure built around paid evaluation challenges. Traders pay an entry fee and must hit specific profit targets while staying within daily and total drawdown limits.

Passing the evaluation unlocks access to a funded account. This approach offers relatively fast access to larger account sizes, but it also introduces pressure during the evaluation phase.

Many traders adapt their strategies specifically to meet challenge conditions, which can differ from how they would normally trade in a non-evaluated environment.

Key Features

- Upfront fee required

- Defined profit targets

- Daily and total drawdown limits

- Funded account granted after evaluation

Model Overview

Paid challenge models provide rapid access to larger account sizes but introduce financial risk before trading begins. Traders must meet specific conditions within a limited timeframe, which can influence trading behavior during evaluation.

Learn more about FTMO’s Prop Trading Firm here.

2. OnFin Prop

Free Investment-Based Prop Trading

Onfin operates using a free prop trading model. Unlike most prop firms, it does not require traders to pay an entry fee or pass a paid evaluation challenge to access prop capital.

The firm monitors trading performance over time and allocates capital based on consistency and risk control, focusing primarily on serious traders (instead of revenue via entry fees).

There are no upfront evaluation fees, which lowers the barrier to entry and changes how traders approach the account.

Rather than pushing for fast profit targets, the structure encourages steady execution and adherence to risk limits. In this setup, the firm only benefits when the trader performs, which aligns incentives differently compared to evaluation-driven models (such as FTMO).

Key Features

- No challenge or evaluation fees

- Capital access without upfront payment

- Performance monitored over time

- Risk management focused on consistency

- Gradual scaling rather than fixed targets

Model Overview

In a free investment-based prop model, the firm only earns when traders generate profits. There is no revenue generated from failed evaluations. This structure lowers the barrier to entry and removes the incentive for traders to optimize strategies solely to pass short-term challenges.

This approach reflects a newer direction in prop trading, where firms act more like capital allocators than evaluators.

Learn more about OnFin’s Free Prop Trading here.

3. The5ers

Conservative Paid Prop Model

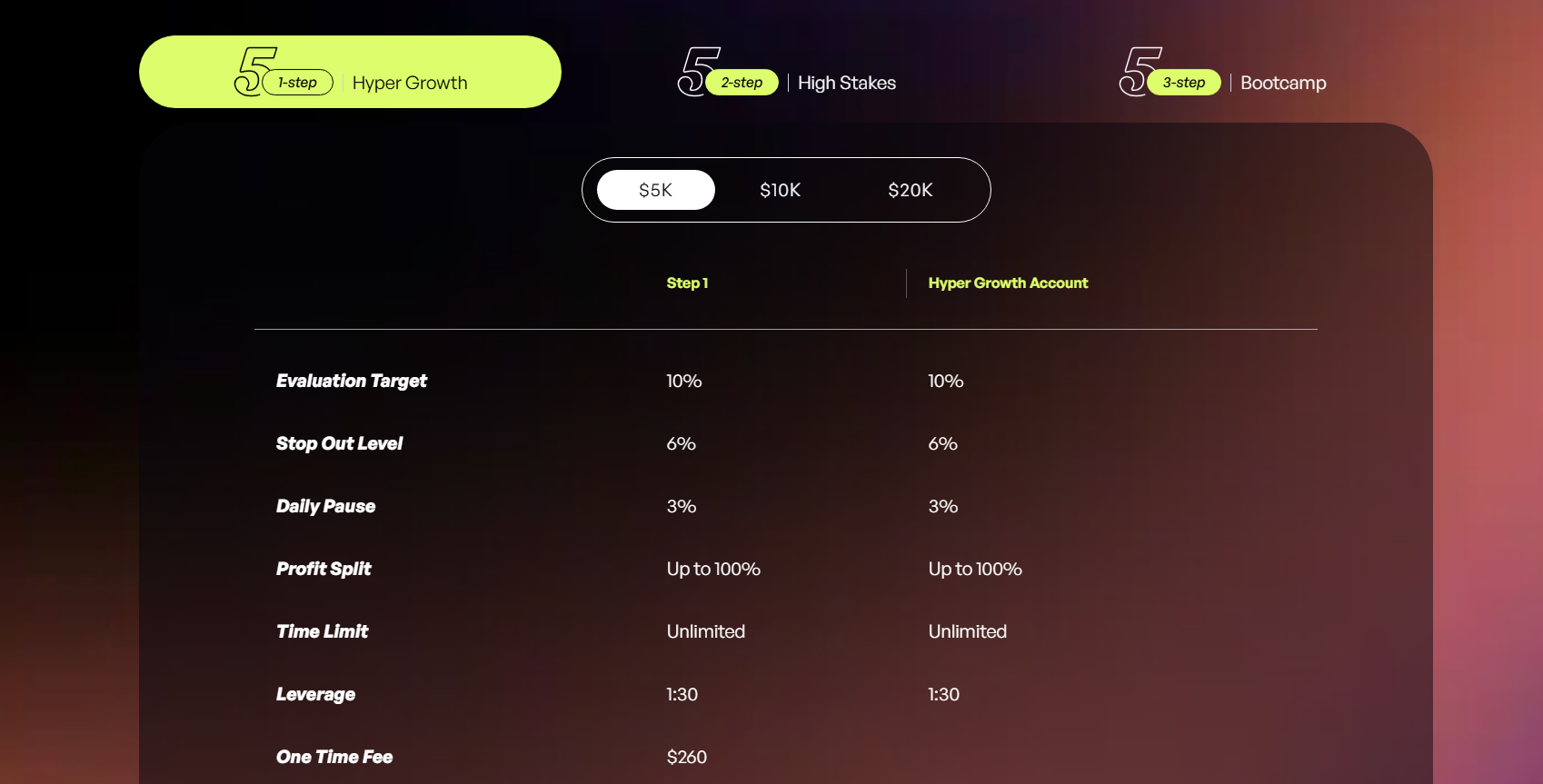

The5ers takes a more cautious approach compared to many challenge-based firms. It still requires an upfront payment, but its rules are designed around lower leverage and slower growth.

The idea is to reward long-term discipline rather than short-term performance. While this reduces some of the pressure seen in aggressive evaluations, the paid entry requirement remains, meaning traders still assume financial risk before accessing firm capital.

Key Features

- Paid entry

- Conservative risk parameters

- Lower leverage compared to competitors

- Slower scaling structure

Model Overview

This model appeals to traders who prioritize capital preservation. However, it still relies on an upfront payment and evaluation process, which places initial risk on the trader rather than the firm.

Learn more about The5ers’ prop offering here.

4. FundedNext

High-Volume Evaluation-Based Prop Firm

FundedNext focuses on scale and accessibility, offering multiple paid challenge options at competitive prices. The onboarding process is fast, and the firm attracts a large international trader base.

Like other challenge-driven models, success depends on meeting evaluation metrics within a defined period. This can encourage trading behavior that prioritizes passing the evaluation rather than maintaining a stable, repeatable strategy.

Key Features

- Paid challenges

- Multiple account types

- Fast onboarding

- Global trader base

Model Overview

This structure favors scale and speed. Traders often focus on meeting evaluation metrics quickly, which may differ from trading conditions outside an evaluation environment.

Learn more about FundedNext here.

5. Other “Traditional” Challenge-Based Prop Firms

Many earlier prop firms such as MyForexFunds and The Funded Trader (also known as TFT) relied almost entirely on paid evaluations as their primary source of revenue.

These firms typically set aggressive profit targets and short timeframes, which made passing difficult for most traders. While the model proved that demand for prop capital was high, it also highlighted a structural issue.

Firms earned from failed evaluations regardless of trading quality, which created a disconnect between trader success and company revenue.

Key Features

All traditional paid prop challenges are built on the same underlying structure:

- Traders are required to pay before they can access capital

- Profit targets are judged over short, predefined timeframes

- Firms earn revenue regardless of whether a trader succeeds

- Evaluations serve both as a filter and as a revenue source

This does not mean these firms are identical in quality or execution. It simply means they all rely on the challenge-based prop trading model, which differs structurally from newer free, investment-based approaches such as OnFin’s Prop offering.

Conclusion

Prop firms are not really defined by their logos, follower counts, or how often their name shows up on social media. What actually matters is how their business model is built and where the incentives sit.

Paid challenge firms still dominate the market, mostly because they offer fast access to capital. The trade-off is clear. Traders pay upfront, trade under pressure, and optimize for passing evaluations rather than trading naturally. For some traders, that works. For many, it quietly distorts how they trade.

Free investment-based prop models remove that upfront barrier and change the dynamic. When there is no fee to recover, the focus shifts toward consistency, risk discipline, and performance over time. Progress is usually slower, but the trading tends to be more honest.

At the end of the day, picking a prop firm is not about choosing the most popular name on a list. It is about choosing a structure that matches how you actually trade, not how a challenge forces you to trade.

If you want to explore a prop trading model without paid challenges, you can take a look at OnFin Prop and see how a free, performance-based approach works in practice.

Alternatively, if you prefer a hands-off option, OnFin’s Copy Trading lets you follow experienced traders and participate in the market without trading manually.