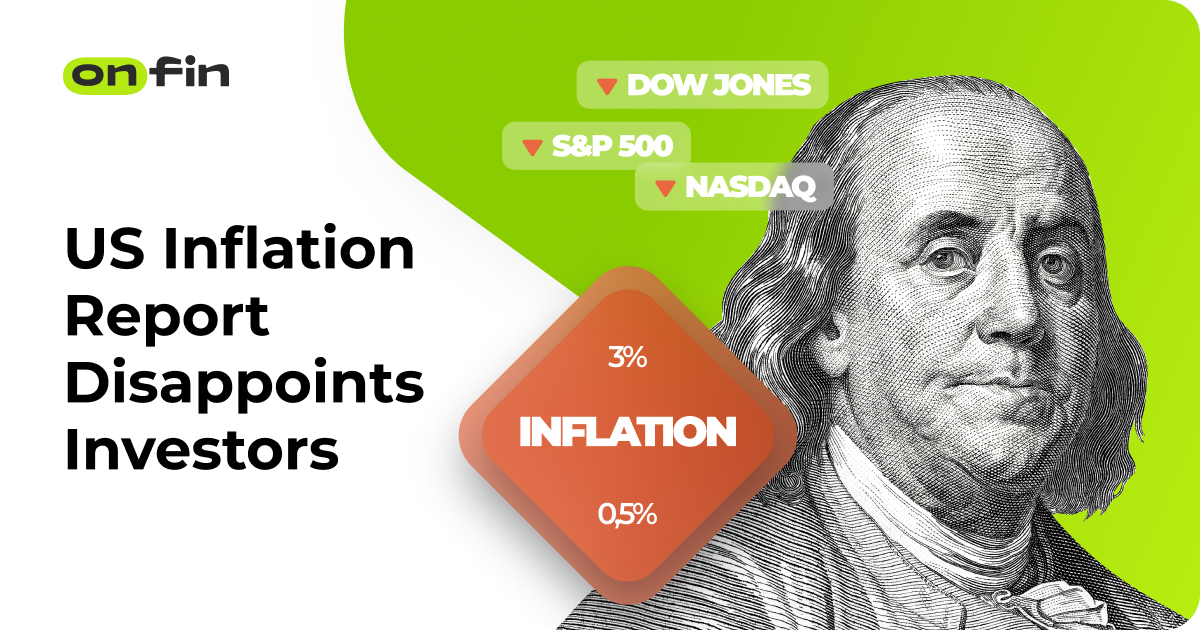

Inflation in the U.S. in January exceeded forecasts, increasing by 3% in annualized terms and by 0.5% – in monthly terms. This increased fears that the Fed will not cut interest rates as significantly as market participants had hoped this year, reports Business Insider.

After the publication of these data, the U.S. stock market went sharply downward, and the yield on U.S. government bonds rose noticeably – at 10-year trejeris it rose by more than 2%, exceeding 4.6%.

“Today’s U.S. inflation report will be a wake-up call for Fed officials and will likely force the Open Market Committee to take a wait-and-see stance indefinitely,” the portal quotes Matthew Ryan, head of market strategy at Ebury Financial Services, as saying. – “The situation is exacerbated by the fact that there are still no clear signs of easing inflationary pressures – wages continue to grow at a strong pace, consumer demand remains strong, and Donald Trump’s tariff policy is likely to make imports more expensive,” he added.