Stock trading can be both exciting and profitable, but it can also feel overwhelming for beginners.

The stock market is a dynamic place, and to navigate it successfully, you need to understand the basics of what stocks are, how they work, and the strategies that professionals use to profit from their price movements.

In this article, we will walk you through the fundamentals of stock trading, explain how to get started, and share valuable tips on how beginners can trade stocks effectively.

What Are Stocks?

In its simplest form, a stock represents ownership in a company. When you purchase a stock, you’re essentially buying a small share of that business. This makes you a part-owner, and your investment’s value fluctuates with the company’s performance.

Stocks are often referred to as “equity” because they give you a stake in the company’s profits and losses.

For example, let’s say you buy shares in a company like Apple. If Apple introduces a popular new product, like the latest iPhone, and sales surge, the company’s stock price will likely increase.

As an investor or trader, you would benefit from this price rise if you decide to sell your shares for a profit.

Different Types of Stock Market Participants

Before diving deeper into trading strategies, it’s important to understand the distinction between stock traders and investors.

- Stock Traders: These individuals typically buy and sell stocks in the short term, aiming to capitalize on price fluctuations. They may hold stocks for a few minutes, hours, or days, often focusing on daily price movements.

- Stock Investors: Investors tend to take a long-term approach. They buy stocks to hold for years or even decades, expecting the company’s value to grow over time, thus generating returns through price appreciation or dividends.

While both traders and investors can profit from stocks, their approaches and time horizons differ significantly.

How Do Stock Prices Move?

Stock prices are influenced by several factors, such as a company’s financial performance, industry trends, economic conditions, and market sentiment.

These prices can rise when a company performs well and investors are optimistic about its future, and they can fall if the company faces challenges or external factors, such as economic downturns or geopolitical tensions.

Let’s take a real-life example: Tesla. When Tesla announced the development of more affordable electric vehicles and its expansion into global markets, its stock price surged due to investor optimism about its growth potential.

Conversely, if the company faces production delays or regulatory challenges, the stock price might drop.

Trading Stocks: A Step-by-Step Approach

Trading stocks successfully requires more than just basic knowledge of the market—it demands a clear strategy, discipline, and an understanding of the tools you need to make informed decisions. Let’s walk through the essential steps of stock trading.

Step 1: Choose a Reliable Broker

To trade stocks, you’ll need to open an account with a stock broker. Your broker will provide you with access to the stock market, trading platforms, and various tools to help you execute trades. When choosing a broker, look for:

- A user-friendly platform: Ensure the platform is intuitive and equipped with necessary tools for technical analysis.

- Competitive fees: Check the commission structure and whether there are hidden fees.

- Good customer support: A broker with responsive customer service is essential, especially for beginners.

- Educational resources: Many brokers offer educational materials, such as webinars, articles, and tutorials, which can be helpful when you’re just starting out.

Online brokers, like OnFin, offer easy access to the stock market with a range of tools and low fees, making them great choices for beginners.

Step 2: Open a Demo Account

Before jumping into live trading, most brokers offer demo accounts that allow you to practice trading with virtual money. This is an excellent way to familiarize yourself with the platform and test your strategies without risking real money. You’ll gain confidence and learn how the market moves without the pressure of financial loss.

Take time to test out different trading techniques and refine your approach in the demo account. Once you feel ready, you can open a real account and start trading with real capital.

Step 3: Develop a Trading Strategy

When it comes to stock trading, having a strategy is crucial. Professionals never trade on impulse—they rely on research, analysis, and a clear plan.

Let’s explore a simple yet effective strategy that works well for beginners.

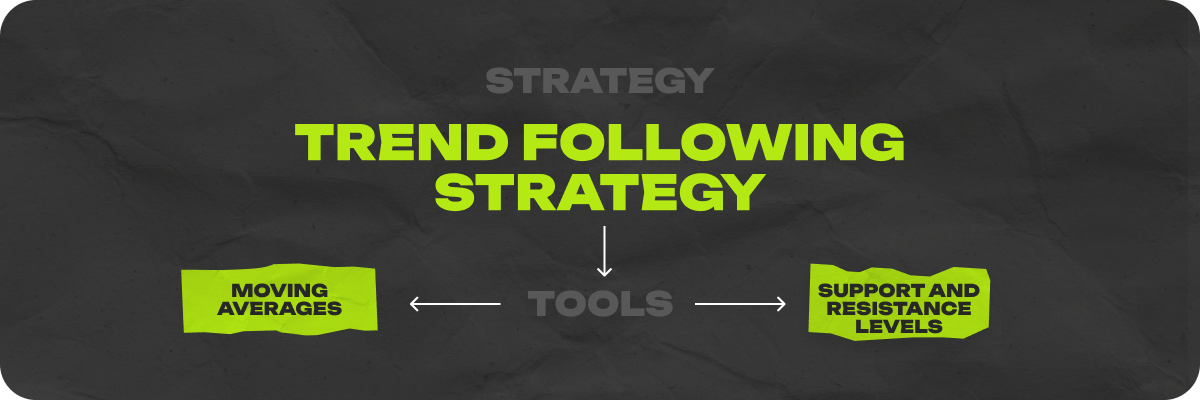

The Trend Following Strategy

The basic idea behind the trend-following strategy is to buy stocks when they are in an upward trend and sell when they are in a downward trend. This strategy involves identifying trends in the market and riding them until signs of a reversal appear.

For example, let’s say you’re watching Microsoft’s stock. If the stock has been rising steadily for weeks and its price is consistently hitting new highs, it’s likely in an uptrend.

According to the trend-following strategy, you would buy the stock with the expectation that the trend will continue. Once the stock begins to show signs of slowing down or falling, you exit the position.

Key Tools for Trend Following:

- Moving Averages: These are used to smooth out price data over a specific period to identify the trend’s direction. A common tool is the 50-day moving average, which helps highlight whether a stock is generally trending up or down.

- Support and Resistance Levels: These levels help traders identify price points where stocks have previously reversed direction. When a stock breaks through resistance, it may signal a continuation of the trend.

How Professionals Use This Strategy

Professional traders use a combination of technical analysis and market knowledge to identify trends. They often rely on charts and indicators to confirm their predictions.

For example, a professional trader might observe that a stock has consistently hit a certain price point and is now poised to break through resistance. Based on this, they may buy shares, expecting the price to rise further.

Professional traders also use risk management techniques such as setting stop-loss orders to limit potential losses. A stop-loss automatically sells a stock if its price drops to a certain level, protecting traders from large losses in case the market turns against them.

Risk Management: Protecting Your Capital

Risk management is one of the most important aspects of trading, especially for beginners. Successful traders know how to limit losses and protect their capital. Here are some key techniques to manage risk:

- Position Sizing: Never risk too much on a single trade. A good rule of thumb is to risk no more than 1-2% of your total trading capital on each trade.

- Stop-Loss Orders: Always use stop-loss orders to automatically exit a trade if it moves against you beyond a certain threshold. This can save you from significant losses.

- Diversification: Avoid putting all your money into a single stock. Spread your investments across different sectors or asset types to reduce overall risk.

Real-Life Example

Let’s look at a professional approach. Imagine you’re trading Amazon stock. The stock has been consistently rising, and a moving average crossover (a short-term moving average crosses above a long-term moving average) signals a potential uptrend.

You decide to buy the stock, setting a stop-loss order just below the recent support level. As the price continues to climb, you decide to sell when the stock hits a new high and shows signs of slowing down, securing a profit.

Final Thought

Stock trading is an exciting way to engage with the financial markets, but it requires knowledge, discipline, and strategy. When you realize the fundamentals of stocks, selecting the right broker, and developing a sound trading strategy, you can set yourself up for success.

Start with a demo account, practice risk management, and continually learn from your experiences. With time and patience, you’ll be able to navigate the stock market with confidence and make informed decisions that align with your financial goals.