The forex market never sleeps — but that doesn’t mean every hour offers the same opportunity. While it’s true that trading is open 24 hours a day, five days a week, not all trading hours are created equal.

To trade forex with precision, timing is a skill as important as knowing your chart patterns or reading economic data.

Understanding global trading sessions can help both new and seasoned traders catch the wave of market momentum — not get crushed by it.

What Are Forex Trading Sessions?

The forex market is decentralized, meaning there’s no single physical exchange. Instead, currency trading flows through an international network of financial centers, and those centers operate on local business hours. When one major region finishes its trading day, another is just getting started. This cycle creates a continuous stream of price movement from Monday to Friday.

There are four primary trading sessions:

- Sydney

- Tokyo

- London

- New York

Each session influences market behavior differently. Tokyo and Sydney often see lighter movement unless Asia-Pacific news breaks. London is known for its volume and volatility. New York is powerful and reactive, particularly to US economic data and global news.

Why Session Timing Matters

Market activity spikes when trading sessions overlap — especially when London and New York are open at the same time. That overlap tends to generate the most liquidity, tighter spreads, and sharper price swings. This is where professional traders often focus their efforts. They know that a highly active market doesn’t just mean movement — it means opportunity.

On the flip side, trading during low-volume hours, like the tail end of the Sydney session, can lead to slippage, wider spreads, and unpredictable price behavior. For beginners, this can feel like navigating a fog. That’s why many experts advise new traders to start by practicing in a demo environment. It allows them to see how price reacts during different times of the day — without risking real money.

Forex Market Hours in UTC

Let’s break it down using Coordinated Universal Time (UTC) for global clarity:

- Sydney: 10 PM – 8 AM

- Tokyo: 11 PM – 9 AM

- London: 7 AM – 5 PM

- New York: 12 PM – 10 PM

What matters more than the start or end time of each session is how they overlap. These overlaps are the gold mines of the forex market.

Key Overlap Periods

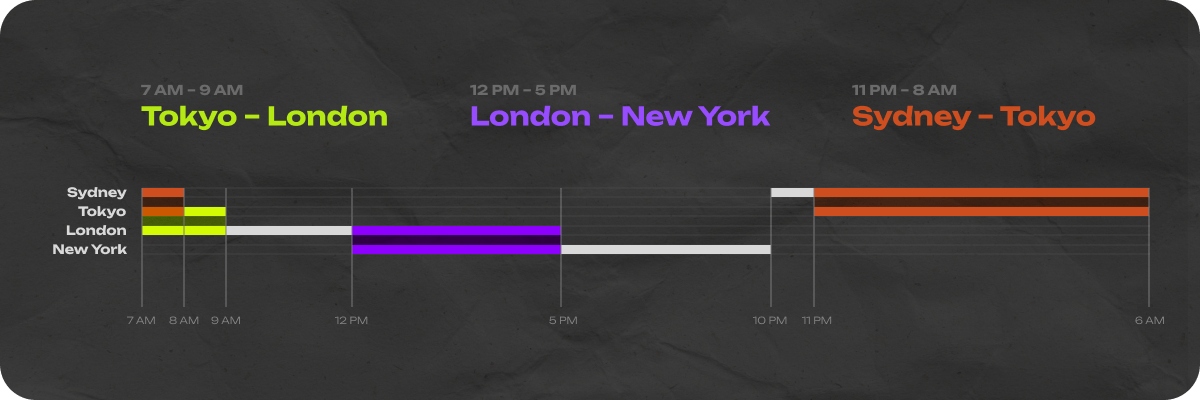

- Tokyo–London (7 AM – 9 AM UTC): While not the most volatile, this session blend can bring movement in JPY and GBP pairs.

- London–New York (12 PM – 5 PM UTC): This is the heartbeat of the forex market. It’s where institutional players are active, economic news releases hit, and volume surges.

- Sydney–Tokyo (11 PM – 8 AM UTC): Ideal for traders focused on AUD, NZD, and JPY. Volatility is lower, but trends can form smoothly.

Professional traders rarely trade outside these peak periods. Not because trades aren’t possible — but because the odds of success diminish. They understand that liquidity and volatility are two core ingredients of profit potential.

Using Session Timing in Strategy

Trading without accounting for sessions is like sailing without checking the wind. Professionals align their strategies with session characteristics.

For example:

- A scalper might only trade during London–New York overlap hours, targeting fast price moves with low spreads.

- A swing trader may enter positions during quieter sessions but plans entries based on momentum expected during London’s open.

- A news trader watches the economic calendar, timing trades with data releases that occur during specific sessions (such as US Non-Farm Payrolls during New York hours).

Even traders using fully automated systems code session filters into their algorithms. Not because it’s fancy — but because it works.

When Not to Trade

There are times best left alone:

- Between 9 PM and 11 PM UTC: The hour after New York closes and before Tokyo opens is often marked by low liquidity and erratic price movement.

- Fridays after 5 PM UTC: Market participants begin closing positions for the weekend, leading to unpredictable behavior.

Also, watch out for times of unscheduled geopolitical news. A sudden speech by a central banker or a breaking global event can cause price chaos. While this can offer profit potential, it also brings risk — especially when trading with high leverage.

Final Thoughts

Forex trading sessions are more than just time slots — they shape the personality of the market. For beginners, understanding how trading hours affect liquidity, volatility, and pricing is foundational. For professionals, session timing becomes part of the strategy itself.

Mastering the rhythm of the forex clock doesn’t require luck. It requires observation, practice, and precision. Trade when the market is alive, and you’ll find yourself on the right side of momentum — where price moves matter, and profits follow.