Finance CFD trading offers investors the flexibility to trade global financial markets without owning the underlying assets. With access to indices, commodities, oil, and stocks, traders can speculate on price movements using leverage.

The growing interest in weekend trading, particularly the Nasdaq weekend index, weekend Dow, and weekend Wall Street opportunities, has reshaped how investors prepare for the upcoming trading week.

This guide explains how to develop professional-level strategies, assess risk efficiently, explore trading opportunities when markets are technically closed, and use platforms like OnFin to gain a competitive advantage.

The article covers oil and index trading, weekend forecasting, and methods for identifying the most undervalued stocks.

Understanding the Basics of CFD Trading

Contracts for Difference (CFDs) allow you to trade the price direction of financial instruments without owning them directly. Finance CFD trading includes markets such as indices, stocks, commodities, and currency pairs.

Leverage magnifies both profits and losses, while fast market access enables execution even during unusual trading hours.

Key Concepts of CFD Trading

- The trader speculates on price differences between trade opening and closing.

- Profits and losses depend on contract size, price change, and leverage used.

- No physical ownership of assets — only price exposure.

- Both rising (long) and falling (short) markets can be utilized.

Market Types

| Asset Type | Typical Use in CFD Trading | Volatility Level | Weekend Access |

| Indices (Dow, Nasdaq) | Speculation and hedging | Medium–High | Limited via futures |

| Oil & Energy | Commodity trading | Very High | Active through trading oil trading CFDs |

| Stocks | Capital growth | Medium | No direct trading, analysis only |

| FX | Liquidity and diversification | High | Often available |

CFD Trading Strategies for Beginners and Experts

Trading strategies must account for leverage, market timing, volatility, and market liquidity. Beginner traders often rely on simplified systems, while experienced investors analyze cross-market signals and global risk sentiment.

Key CFD Strategies

- Breakout Trading. Useful during high-volatility sessions. Traders place pending orders beyond support/resistance levels and target large intraday movements.

- Hedging via Index CFDs. Professionals hedge stock exposure using weekend Wall Street futures or weekend Dow contracts to minimize risk before market opening.

- News-Based Trading. Major financial releases including jobs data, OPEC announcements, interest rate changes, often drive oil trading or index volatility.

- Trend Continuation Models. Use technical indicators (e.g., moving averages) to identify sustained market direction.

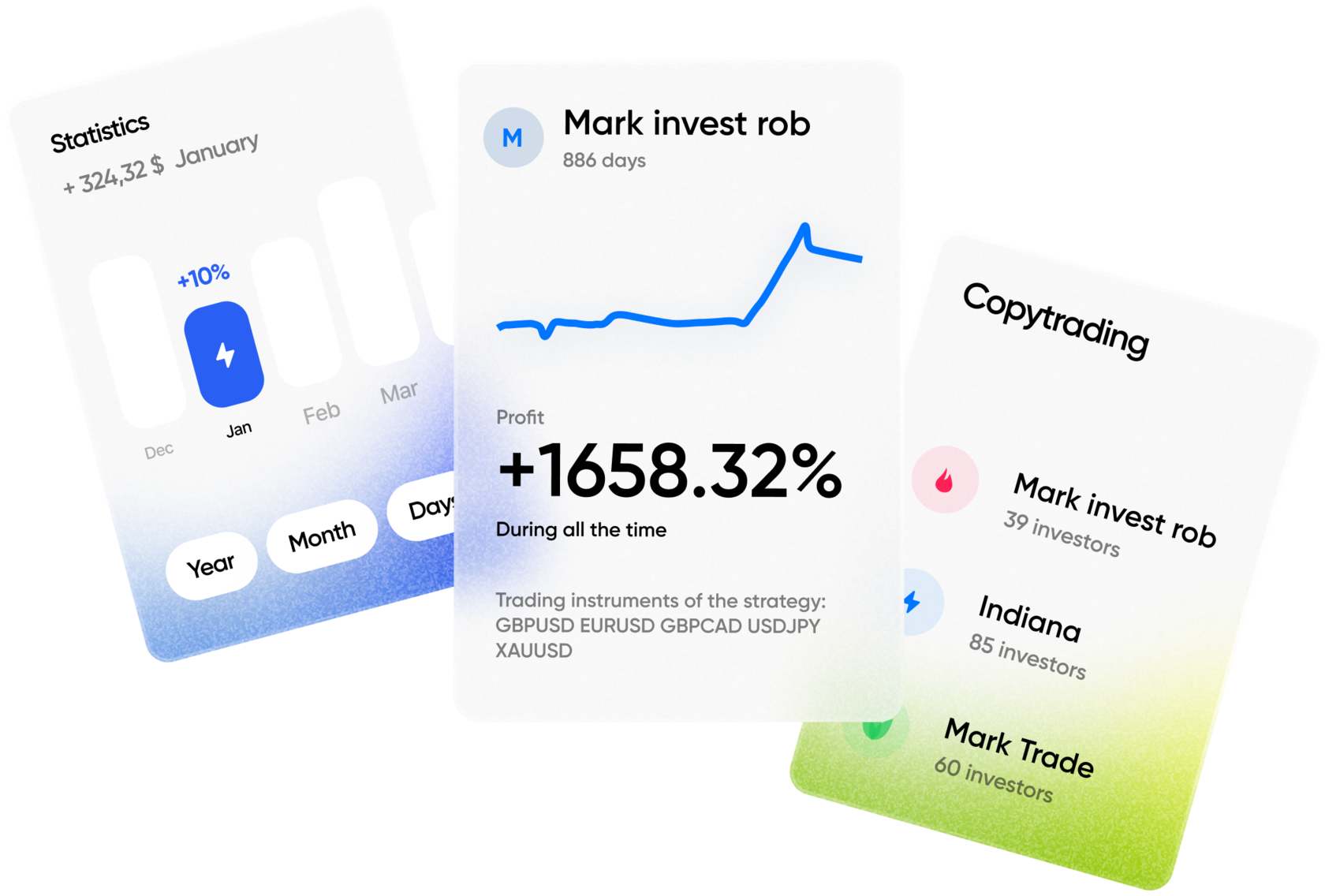

- AI-Enhanced Trading Robots. Applied on platforms like OnFin where traders can set advanced execution rules, especially when monitoring Nasdaq futures.

Advantages and Risks of Finance CFD Trading

CFDs open access to diversified portfolios with lower capital requirements. Still, volatility and leverage require disciplined risk planning.

Advantages

- Low initial capital due to leverage

- Access to global markets from a single account

- Ability to trade both long and short

- No stamp duty on some markets (depending on jurisdiction)

- Availability of Nasdaq weekend index insights

Risks

- High exposure may lead to rapid losses

- Overnight and weekend gaps can affect position outcomes

- Margin calls can liquidate trades prematurely

- Reduced liquidity during off-hours

- Regulatory differences across platforms

Nasdaq Weekend Index: What Happens When Markets Close

Although stock markets close for the weekend, traders continue evaluating future price action via futures contracts, Nasdaq weekend index activity, and broker-provided synthetic tracking. Platforms like OnFin display forward-projected prices allowing traders to forecast Monday’s opening.

How to Track Nasdaq Futures Over the Weekend

Weekend futures activity helps predict potential opening gaps. Traders monitor several data sources.

Useful Tracking Methods

- Broker-Based Synthetic Pricing. Leading platforms provide weekend price projections based on interbank derivatives.

- Economic Calendar Review. Anticipate macroeconomic risk ahead of Monday.

- Mobile notifications & auto-stop levels. OnFin offers configurable price alerts reacting to price movements even during closure.

- Intermarket comparison. Compare Nasdaq signals with weekend Dow and crude oil CFDs.

Weekend Trading Opportunities on the Nasdaq Index

Weekend trading focuses on sentiment, price gaps, and risk hedging.

Key Weekend Opportunities

- Observing volume concentration in tech-heavy sectors

- Setting pending orders to capture potential breakout at market open

- Assessing geopolitical risk impacting Nasdaq

- Reviewing economic indicators that influence tech stocks

- Using defensive CFD strategies before Monday’s volatility

Trading Oil: Global Energy Markets and Investment Strategies

The oil market remains active despite formal closure. Oil trading through CFDs allows capitalizing on global energy dynamics including supply-demand fluctuations, geopolitical tensions, OPEC agreements, and macroeconomic expectations.

How to Trade Oil CFDs Effectively

Oil trading demands strict analytical discipline and an advanced understanding of leverage. Due to high price volatility and sensitivity to geopolitical risk, position timing and exposure management are critical. Traders must focus on fundamental market drivers, technical price zones, and macroeconomic sentiment to achieve consistent performance.

Best Practices for CFD Oil Traders

1. Analyze production reports and storage levels

Monitoring global production reports allows traders to assess supply-side pressure and anticipate potential price direction. Storage data, such as weekly U.S. EIA reports, helps determine whether demand is increasing or weakening. A surplus typically signals downward pressure on crude prices, while reduced inventory often supports bullish momentum. This fundamental insight assists traders in setting entry points before major market reactions.

2. Trade using defined risk rules: maximum 2% per position

Limiting risk exposure to no more than 2% per position helps prevent large account drawdowns during high volatility periods. Oil CFDs exhibit extreme price swings, so even a small miscalculation can lead to substantial losses without strict capital management. This rule forces traders to size positions according to current market risk levels rather than expected returns. Consistent application improves long-term profitability.

3. Monitor USD fluctuations

Oil prices are denominated in USD, making currency strength a key driver of price movement. A stronger dollar typically leads to weaker oil prices due to increased purchasing cost for non-U.S. markets. Traders track currency trends alongside oil charts to avoid misaligned directional exposure. Incorporating currency analysis helps identify hidden risks that pure technical analysis may overlook.

4. Track OPEC announcements

OPEC decisions significantly influence global supply and can trigger immediate market shifts. Production cuts often create bullish momentum, while increased output expectations may drive bearish trends. Traders should evaluate meeting summaries and consumer demand forecasts before adjusting positions. Reacting proactively to OPEC insights provides an edge over traders who rely solely on chart-based analysis.

5. Utilize OnFin’s extended-hour oil audit tools

OnFin’s extended-hour audit tools allow traders to analyze oil price behavior beyond standard market sessions. These tools provide access to synthetic pricing, global energy flow metrics, and risk indicators before the official market open. Advanced monitoring capabilities help define more accurate entry and exit levels for CFD positions. Using extended-hour insights supports strategy refinement and reduces exposure to Monday morning gaps.

Oil Market Analysis: Technical and Fundamental Insights

Oil traders typically combine chart patterns and macroeconomic analysis.

Technical and Fundamental Factors

- Rising triangle pattern supports bullish outlook

- Moving averages suggest momentum direction

- Demand elasticity based on global transportation figures

- Inventories and refinery data from EIA

- Political tensions impacting supply routes

Weekend Wall Street: How the Market Reacts When Closed

Wall Street closures don’t halt sentiment formation. Trader communities review unofficial pricing, forward contracts, and global equity performance.

Preparing for Monday: Analyzing Weekend Market Sentiment

Monday gap risk management is a core strategy for professional traders.

How to Prepare

- Align week-start trades with market sentiment

- Research political news, earnings, and commodities

- Map correlation between weekend Wall Street projections and energy markets

- Monitor European and Asian session reaction before U.S. opening

- Use trailing stops ahead of volatile open

Weekend Trading Tips for Stock and Index Traders

Successful traders anticipate volatility and manage order execution rather than entering speculative positions during market closure. They focus on preparing structured strategies, assessing correlation risks, and aligning exposure limits rather than trying to profit from unavailable liquidity. Weekend analysis is used as a planning stage to optimize execution once the market reopens.

1. Focus on hedging instead of direct trading

Hedging aims to protect existing positions against potential price gaps that may occur when markets reopen. Traders use correlated assets such as index futures or commodities to reduce portfolio drawdowns without liquidating the core position. This strategy minimizes risk during closed periods and is especially valuable in high-volatility environments. It turns weekend uncertainty into a controlled exposure scenario.

2. Use futures and CFDs for exposure control

Futures and CFDs offer flexibility due to leverage and lower capital requirements, making them ideal tools for adjusting exposure quickly. During weekends, traders analyze futures contracts to anticipate how markets may open and set conditional orders accordingly. CFDs allow implementing defensive tactics if prices move against expectations. These instruments give traders tactical advantages without altering long-term investment strategies.

3. Review trading metrics from the previous week

Evaluating last week’s volatility, entry accuracy, and trade execution helps identify weaknesses before the upcoming session. Traders examine metrics such as average win rate, drawdown percentage, and trading frequency to refine their strategy. Analyzing historical performance supports more objective decision-making. It also prevents repeated mistakes by identifying patterns that could persist into the next trading cycle.

4. Apply strict risk-to-reward parameters

Clear risk-to-reward ratios ensure trades are structurally sound before committing capital. Professional traders typically use ratios such as 1:2 or 1:3 to maintain mathematical profitability over multiple trades. By setting predefined limits, they avoid oversized positions and forced reactions during market reversals. This discipline increases the likelihood of long-term portfolio growth.

5. Eliminate emotional decision-making ahead of market opening

Emotion-driven trading often leads to impulsive entries, unnecessary repositioning, or ignoring risk rules following market gaps. Completing all strategic decisions over the weekend helps avoid pressure during rapid price movements on Monday. Traders use automation tools, pending orders, and predefined exit plans to minimize psychological impact. Reducing emotional interference leads to consistent and controlled execution.

The Weekend Dow: Dow Jones Trends and After-Hours Futures

The weekend Dow often predicts equity movements, particularly for industrial and cyclical sectors. Futures reflect macroeconomic expectations and global investor sentiment.

How to Interpret Dow Jones Weekend Movements

Analytical systems examine trend slope, foreign market correlations, and oil market linkage.

Indicators of Dow Weekend Trends

- Divergence between U.S. and Asian markets

- Futures activity relative to treasury yields

- Employment and manufacturing data influence

- Inflation outlook impact

- Technical levels tested before market reactivation

Most Undervalued Stocks to Watch Now

Investors seek long-term opportunities beyond market hype. Identifying the most undervalued stocks involves fundamental review, price-to-earnings recalibration, sector rotation, and company resilience analysis.

How to Identify Undervalued Stocks Using Fundamental Analysis

Evaluation frameworks assess balance sheet strength, discounted cash flow, earnings predictability, and sensitivity to external conditions.

Core Fundamental Metrics

- P/E ratio: Low vs. sector average

- Debt-to-equity levels: Financial sustainability

- Dividend history: Signals robust cash flow

- Return on equity (ROE): Strength of business model

- EPS growth: Long-term performance consistency

Sectors with the Most Undervalued Stocks in 2025

Sectors emerging from transformational cycles often provide value-triggers.

High-Potential Sectors

- Renewable Energy: Following regulatory incentives

- AI & Automation: Valuation recalibrations post-expansion period

- Industrial Manufacturing: Linked to Dow movements

- Healthcare Technology: Aging population demands

- Commodity-Based Enterprises: Strong oil-linked potential

Weekend Market Overview: Wall Street, Dow, Nasdaq, and Oil Outlook

Weekend market evaluation prepares traders for strategy adjustment on Monday. Combining insights from finance CFD trading, weekend Wall Street, weekend Dow, and Nasdaq weekend index, investors can form comprehensive positioning models.

Full Weekend Analysis Checklist

- Study correlation between Dow and oil prices

- Compare Nasdaq tech-leading signals with futures price behavior

- Review global economic indicators published post-market closure

- Identify major geopolitical influences

- Construct hedge scenarios before trading open on platforms like OnFin

Final Thought

Professional traders use weekend insights not for speculation but strategy refinement. Reviewing weekend data on trading oil trading, index futures, and identifying the most undervalued stocks helps develop tactical plans for Monday.

OnFin’s platform allows monitoring of asset pricing during downtime, setting automated execution levels, and combining CFD analyses into a unified position management strategy. Regardless of experience level, sophisticated planning is the ultimate differentiator in finance CFD trading.