European stock markets ended Monday trading at their lowest level in two months. The decline followed worsening economic prospects in the eurozone. Concerns over trade tariffs also weighed on investor sentiment, according to Reuters data.

Goldman Sachs downgraded its eurozone GDP growth forecast. The bank also predicted additional interest rate cuts of 0.25 percentage points. Both the U.S. Federal Reserve (Fed) and the European Central Bank (ECB) are expected to implement these rate reductions.

The pan-European STOXX 600 index fell by 1.5%. It marked its fourth consecutive session of losses. This was the index’s largest one-day decline in nearly three weeks. The regional market volatility index rose to its highest level during the same period.

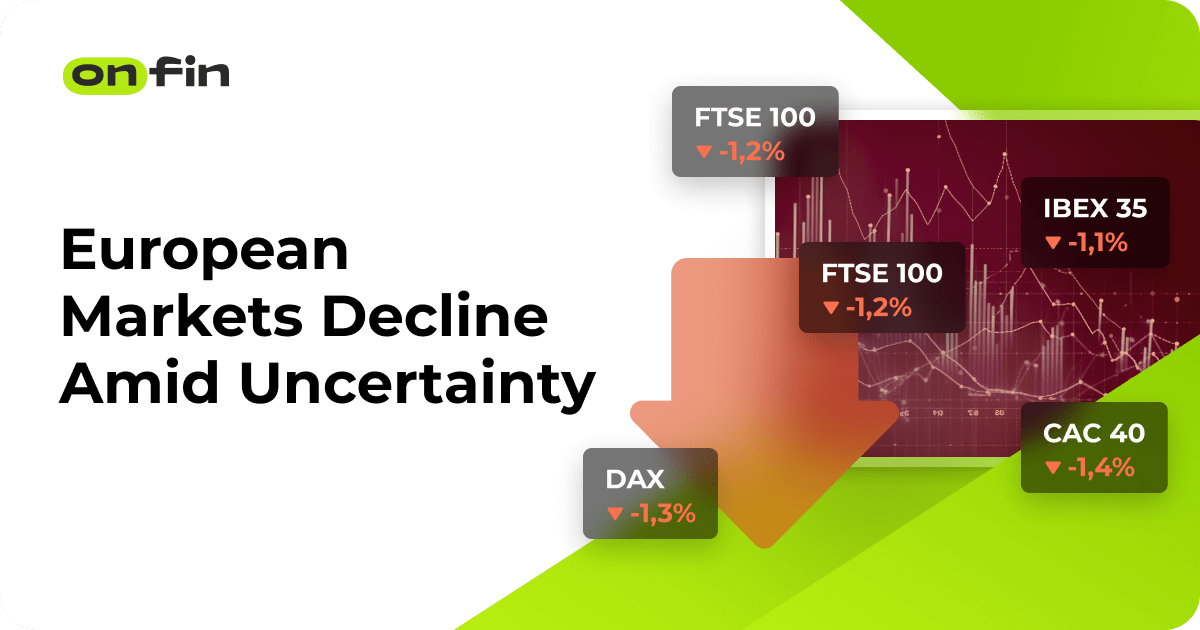

All major European stock exchanges recorded declines of more than 1%. Investors moved capital into safe-haven assets. This shift came amid growing global economic uncertainty.

The DAX index in Germany fell by 1.3%. France’s CAC 40 dropped 1.4%. The FTSE 100 in the UK declined by 1.2%. Southern European markets also experienced losses. Spain’s IBEX 35 slid by 1.1%, while Italy’s FTSE MIB decreased by 1.3%.

Analysts cited weak industrial data from Germany as a contributing factor. Retail sales in several eurozone countries showed signs of stagnation. Manufacturing output slowed across the bloc.

The technology sector posted the steepest losses in the STOXX 600. Shares of semiconductor and software companies dropped significantly. Energy and industrial sectors also saw notable declines.

Investors are bracing for retaliatory tariffs from the United States. The new U.S. measures are expected to take effect on April 2. These actions could impact transatlantic trade and market stability.

The euro weakened slightly against the U.S. dollar. Government bond yields fell across Europe. The yield on Germany’s 10-year Bund dropped by 5 basis points.

Currency volatility increased during Monday’s trading. The British pound also lost ground amid economic uncertainty.

Central banks are monitoring inflation trends closely. Recent data indicates core inflation remains below targets. Policymakers may act further to support growth.

Analysts expect market uncertainty and elevated volatility to persist. Investors are likely to remain cautious in the near term. More economic indicators are scheduled for release later this week.