The world of securities trading is exciting, dynamic, and can be highly rewarding. Whether you’re looking to grow your wealth, generate passive income, or diversify your portfolio, understanding how securities work is crucial.

In this guide, we’ll break down what securities are, how to trade them, and the strategies that can help beginners make informed decisions.

Along the way, we’ll explore how professionals approach trading, what tools you might need as a beginner, and the different types of securities available.

What Are Securities?

In simple terms, securities are financial instruments that represent a form of investment. They can be bought or sold on financial markets and generally represent ownership or a debt owed to the investor.

Securities can come in many forms, but the two main types are equity securities (stocks) and debt securities (bonds). These assets can be traded, providing investors with opportunities to profit, based on the performance of the underlying asset.

At their core, securities offer an ownership stake in a company or a claim on a company’s assets, or they represent a loan agreement between the borrower and the lender.

A stockholder, for example, may receive dividends from the company if it performs well, while a bondholder will receive interest payments over time.

Types of Securities

Securities are not one-size-fits-all. They come in different types, each with its own risk and return profile. Let’s break down some of the most common securities that beginner traders encounter:

- Equity Securities (Stocks). These represent ownership in a company. When you buy a stock, you’re essentially buying a small piece of that company. Stocks can be a powerful way to grow your wealth, as their value may increase over time, and you may also receive dividends. Companies like Apple, Amazon, and Tesla issue stock, and their performance on the market often mirrors the overall health of the company.

- Debt Securities (Bonds). Bonds are loans that investors give to corporations or governments. In exchange for the loan, the issuer promises to pay the investor regular interest and return the principal at the end of the bond’s term. Bonds tend to be less risky than stocks, but they also offer lower returns. They are ideal for those seeking more stable and predictable income.

- Fixed-Income Securities. These are a subset of debt securities, like bonds, but with an added guarantee: they pay a fixed interest rate over time. This makes them appealing to more conservative investors who want a reliable income stream without worrying about fluctuating market conditions.

- Mortgage-Backed Securities (MBS). These securities are based on a pool of mortgages. They allow investors to buy into a set of loans (usually home loans) and receive payments as homeowners pay their mortgages. MBS can be more complicated than bonds or stocks, but they provide exposure to the real estate market.

- Marketable Securities. These are highly liquid, short-term investments, typically bought by companies to generate a return on their excess cash. They can be easily bought or sold in financial markets. Marketable securities offer investors a safe, low-risk option, but with modest returns.

How to Trade Securities

Trading securities may seem intimidating at first, but it can be broken down into manageable steps. As a beginner, you’ll want to learn the basics of how to execute trades and where to trade them. Here are a few ways to get started:

Through Brokerage Accounts

A brokerage account is one of the easiest and most common ways to trade securities. Brokerages serve as the middleman between investors and the financial markets, providing the platform for buying and selling assets like stocks, bonds, or ETFs.

There are two primary types of brokerage accounts:

- Full-Service Brokers: These brokers offer a wide range of services, including advice, research, and trade execution. They tend to be more expensive but may be a good choice for those just starting out and seeking guidance.

- Online Discount Brokers: These platforms offer lower fees and are ideal for self-directed investors who prefer to make their own decisions and manage their trades independently.

Direct Trading

Direct trading allows you to buy securities directly from the issuer—such as stocks from a company or bonds from the government.

This method is less common but may offer certain advantages, like lower fees, depending on the issuer’s policies.

Banks

While banks typically don’t trade stocks directly, they offer certain types of securities like bonds and mutual funds.

Banks can be an option if you’re looking for a more traditional, low-risk investment.

Peer-to-Peer Trading

This method involves buying and selling securities directly with another person, bypassing the traditional exchanges.

It’s more complex and involves more risk, but it can provide opportunities for unique trades not found on traditional platforms.

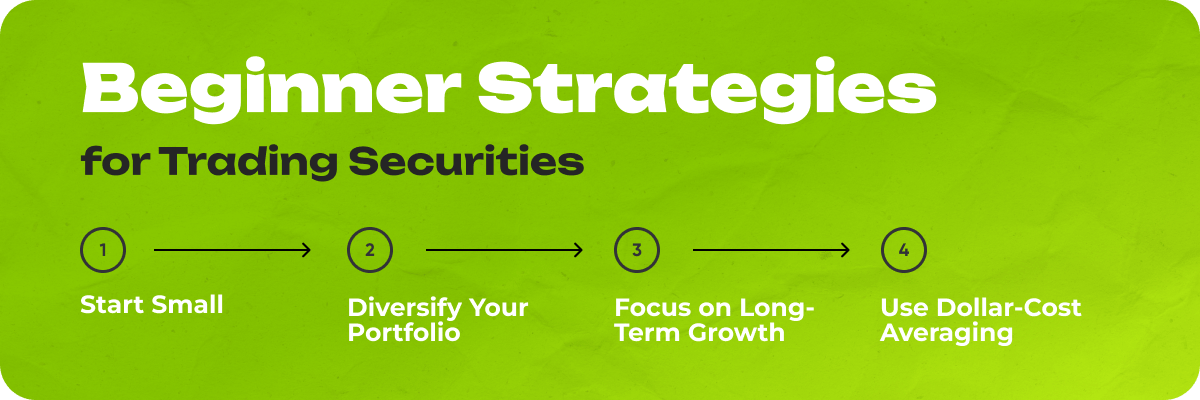

Beginner Strategies for Trading Securities

As a beginner, you want to focus on understanding the market and developing strategies that help mitigate risks while still providing opportunities for growth. Here are some strategies that can work well for new traders:

Start Small

As you begin trading, it’s essential to start with small amounts of money. This helps limit your potential losses as you learn.

Over time, you can gradually increase your investments as you gain confidence and experience.

Diversify Your Portfolio

Diversification is key to managing risk. By holding a variety of securities (stocks, bonds, ETFs), you can reduce the impact of a poor-performing asset.

This means you’re not putting all your eggs in one basket, which can protect you from large losses in volatile markets.

Focus on Long-Term Growth

The stock market tends to grow over the long term, despite short-term volatility.

Many professional investors, including Warren Buffett, have built wealth by holding stocks for years, taking advantage of compound growth.

Use Dollar-Cost Averaging (DCA)

DCA involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps you avoid trying to time the market, which is nearly impossible for beginners.

DCA smooths out the ups and downs, allowing you to buy more shares when prices are low and fewer shares when prices are high.

Tools You’ll Need to Trade

As you dive into trading, you’ll need the right tools to help you make informed decisions. Here are some essential resources for beginners:

- Trading Platforms. Most traders use online platforms to place trades. Brokers like OnFin offer easy-to-use interfaces, educational resources, and access to different types of securities.

- Stock Screeners. These tools help you filter stocks based on specific criteria, like market cap, earnings, or sector. Stock screeners make it easier to find securities that align with your investment goals.

- News and Analysis Tools. Staying up-to-date with the market is crucial for successful trading. Use news sources like Bloomberg or CNBC, and analytics platforms like TradingView, to track market trends and receive expert insights.

- Financial Newsletters. Many professional investors subscribe to financial newsletters that provide stock recommendations, market updates, and in-depth analysis. While these should be used as supplemental tools, they can help guide your investment decisions.

Professional Trading: How Experts Approach the Market

Professional traders use a variety of strategies to maximize their returns. Many focus on technical analysis, studying price charts and market trends to predict future movements. Others rely on fundamental analysis, evaluating a company’s financial health, products, and management before making decisions.

Some professionals use more advanced techniques like options trading, where they buy or sell the right to purchase a security at a specific price in the future. This can be a more complex strategy, but it allows traders to profit from both rising and falling markets.

The Bottom Line

Trading securities can be an exciting way to build wealth, but it’s important to approach it with a clear strategy, patience, and an understanding of the risks involved.

As you continue to learn about different securities, trading platforms, and market strategies, you’ll become more adept at making decisions that align with your financial goals.

Start small, use the right tools, and don’t rush the learning process. Over time, you’ll find your rhythm and begin to develop strategies that work best for you.