Backtesting is the process of using historical price data to evaluate how a selected trading strategy could perform. This approach makes it possible for traders to predict how certain tactics can be used under similar market conditions in the future. Essentially, you are applying your strategy to historical market data to simulate how it would have worked in real-world scenarios.

When backtesting Forex strategies, traders often rely on technical indicators (like moving averages or RSI) and price action to determine entry and exit points. The goal is to see if the strategy would have been profitable or if it needs adjustments before being applied in live trading.

What Is Backtesting in Forex?

Backtesting is a method used by Forex traders to evaluate how well a trading strategy would have performed by applying it to historical market data. It involves simulating trades based on past price movements to understand how a strategy might behave in real-world conditions.

By using this approach, traders gain insights into the potential effectiveness of their strategies before committing real money to them, allowing them to identify weaknesses and refine their approach. Essentially, it’s a way of testing a strategy without any risk, by seeing how it would have reacted in previous market situations.

The process of backtesting enables traders to evaluate the performance of their strategy over a set period, using technical indicators, chart patterns, and price action analysis. This helps in fine-tuning the strategy and understanding its risk-to-reward ratio, giving traders a clearer picture of its potential success.

Why Backtesting Is Essential for Forex Traders

Backtesting provides several key benefits, especially for beginners who are still learning the ins and outs of Forex trading:

- Gain Insights into the Strategy: Backtesting allows you to gain a better understanding of how your strategy works. By applying it to historical data, you can evaluate its effectiveness and adjust it accordingly to improve its performance.

- Develop Technical Skills: Backtesting helps traders develop essential technical analysis skills. By reviewing past market conditions, you become more adept at identifying trends, support/resistance levels, and other key factors that can influence your trades.

- Build Trading Confidence: One of the greatest benefits of backtesting is that it boosts your confidence. As you evaluate your strategy on historical data, you’ll be able to gauge its reliability. This builds trust in your trading decisions and prepares you for real trading conditions.

- Risk Management: Backtesting helps traders assess risk by allowing them to see potential losses and gains under different market scenarios. This is invaluable for managing risk and ensuring that your strategy aligns with your risk tolerance.

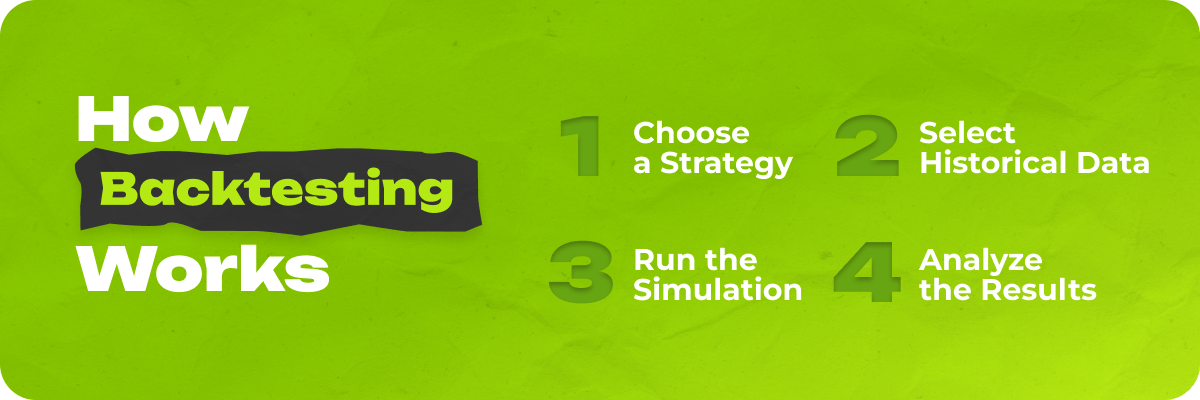

How Backtesting Works

Backtesting works by using historical price data to simulate trades according to a specific strategy. The process generally involves the following steps:

- Choose a Strategy: Before you can backtest, you need to have a clear trading strategy. This could involve any combination of technical indicators, chart patterns, or fundamental analysis.

- Select Historical Data: Choose a period of historical data to run the backtest. This could range from a few weeks to several years, depending on the strategy and the timeframes you’re interested in testing.

- Run the Simulation: With backtesting software, you apply your chosen strategy to the historical data. The software automatically simulates each trade based on your strategy’s rules and conditions.

- Analyze the Results: After the backtest is complete, analyze the results. Key performance indicators (KPIs) like profit and loss (P/L), return on equity (ROE), win/loss ratio, and volatility can give you valuable insights into how effective your strategy is.

Beginner Backtesting Tools

There are various tools available to backtest Forex strategies, ranging from manual methods to more sophisticated automated software. Here are two popular options:

1. Demo Account Testing

Using a demo account is one of the easiest ways to backtest your Forex strategies without risking real money. Most brokers offer demo accounts where you can trade using virtual funds under real market conditions.

Demo accounts allow you to practice applying your strategies with access to various technical indicators and charting tools.

Why it’s useful for beginners: A demo account helps beginners get comfortable with the mechanics of trading without the pressure of losing real money. It provides a hands-on learning experience and allows you to test strategies in a risk-free environment.

2. Manual Account Testing

Manual backtesting involves reviewing historical data on a chart and simulating trades based on your strategy. It’s a more time-consuming process but offers a deeper understanding of how the Forex market works.

You’ll need to examine historical price movements, noting key points of entry and exit, and evaluate how the strategy would have performed.

Why it’s useful for beginners: While manual backtesting can be labor-intensive, it’s an excellent way for beginners to learn about market structure, price action, and how to apply strategies. It also helps traders develop patience and a better understanding of the dynamics of the market.

How Professionals Use Backtesting

Professional traders rely heavily on backtesting to refine their strategies. They use advanced backtesting platforms that can simulate thousands of trades in minutes, allowing them to optimize their strategies before using them in live markets.

These tools also allow traders to fine-tune various parameters, such as trade size, stop-loss placement, and take-profit targets, to maximize profitability.

For example, a professional might use a backtesting tool to test a strategy that trades on the four-hour chart using moving averages.

A trader would load several years of historical data and adjust parameters such as the period of the moving averages to see how different settings affect performance.

Real-world example: A professional trader might test a trend-following strategy using the 50-period and 200-period moving averages. If the backtest shows consistent profits when the 50-period crosses above the 200-period moving average, the trader might use this as an entry signal in their live trades.

Skills and Tools Needed for Effective Backtesting

Backtesting requires both technical skills and the right tools. Some of the skills and tools you’ll need include:

- Technical Analysis Skills: A strong understanding of technical indicators, chart patterns, and price action is essential for effective backtesting. The more familiar you are with these concepts, the more accurately you can test your strategies.

- Familiarity with Backtesting Software: There are many software options for backtesting, from free tools like TradingView to more advanced platforms like MetaTrader 4/5 or third-party software like Forex Tester. Understanding how to use these tools effectively is critical for getting accurate results.

- Patience and Attention to Detail: Backtesting can be a tedious process, especially when done manually. To ensure you’re getting valid results, you need to be patient and detail-oriented when applying your strategy to historical data.

- Data Analysis: Once the backtest is complete, you need to analyze the results carefully. Key metrics like profit factor, maximum drawdown, and win rate will tell you how well your strategy performs under different market conditions.

Conclusion

Incorporating backtesting into your Forex trading routine can really make the difference. Especially, when it comes to improving your chances of success. It allows you to assess the viability of your strategies, gain practical experience, and enhance risk management before engaging in live trading.

For those just starting, backtesting serves as a valuable learning tool, helping you better understand the dynamics of the market and the nuances of technical analysis. By investing time in this process, you’re not only refining your trading approach but also increasing your confidence and decision-making ability.

Whether you choose to backtest manually or use automated tools, the knowledge and experience gained from backtesting are key to navigating the Forex market effectively.