Spreads are a fundamental concept in financial markets, influencing the cost of every trade. In simple terms, a spread represents the difference between an asset’s bid (selling) price and the ask (buying) price. Brokers and liquidity providers earn profits from this difference, particularly in commission-free trading environments.

In forex trading, spreads are the primary cost traders pay when executing orders. Unlike stocks, where traders might pay commissions, forex brokers often include their charges in the spread. Understanding spreads is crucial because they impact profitability, trading strategies, and overall market efficiency.

Example: A trader looking to buy the EUR/USD currency pair at 1.2050 and finding a selling price of 1.2048 encounters a spread of 2 pips. This cost is deducted immediately upon order execution, meaning the trade needs to move at least 2 pips in the trader’s favor to break even.

Why Do Spreads Exist?

Spreads exist due to supply and demand dynamics. When there is high liquidity and many buyers and sellers, the spread tends to be narrower. Conversely, when liquidity is low or market volatility is high, spreads widen. This means that traders should always consider market conditions before entering a trade, as wider spreads can increase trading costs.

Use Case: During the London and New York trading sessions, spreads tend to be lower due to high trading volume. In contrast, spreads widen significantly during the weekend or major holidays when liquidity is low, making it riskier to place trades during these periods.

Key Components of a Spread

Every spread consists of two primary components:

- Bid Price – The price at which traders can sell an asset.

- Ask Price – The price at which traders can buy an asset.

The difference between these two prices is the spread.

Example: If the EUR/USD currency pair has a bid price of 1.2000 and an ask price of 1.2002, the spread is 2 pips. In contrast, an exotic currency pair like USD/TRY might have a spread of 8-10 pips due to lower liquidity.

Types of Spreads in Trading

Spreads can be classified into two main types: fixed spreads and variable spreads. Each type has unique characteristics and suits different trading strategies.

Fixed Spreads

Fixed spreads remain constant regardless of market conditions. Brokers offering fixed spreads act as market makers, meaning they set the bid and ask prices rather than relying on external liquidity providers.

Advantages of Fixed Spreads:

- Predictable trading costs: Traders always know what spread to expect.

- Suitable for beginners: Fixed spreads simplify cost calculations.

- Lower capital requirements: Many brokers offering fixed spreads have lower deposit requirements.

- Not affected by volatility: Traders can execute orders even during news events.

Disadvantages of Fixed Spreads:

- Possible requotes: Orders may be rejected if prices move too quickly.

- Limited flexibility: Fixed spreads might be higher than variable spreads in stable market conditions.

Example: A broker offers a fixed spread of 3 pips on EUR/USD. If the market becomes volatile due to economic news, the spread remains at 3 pips, ensuring predictability for traders.

However, this also means traders might miss better pricing opportunities available in variable spread environments.

Variable Spreads

Variable spreads fluctuate based on market conditions. They are determined by liquidity providers, meaning they can widen or narrow depending on factors like volatility, news events, and overall market demand.

Advantages of Variable Spreads:

- No requotes: Orders execute at market prices without rejection.

- Lower costs in stable conditions: When liquidity is high, spreads are typically tighter.

- More transparency: Traders can see real-time changes in spreads based on supply and demand.

Disadvantages of Variable Spreads:

- Unpredictable costs: Spreads can widen unexpectedly, increasing trading expenses.

- Not ideal for high-frequency trading: Sudden spread increases can disrupt short-term strategies.

Example: During regular market hours, EUR/USD may have a spread of 1 pip. However, the spread could widen to 5 pips or more during major news releases like a Federal Reserve announcement.

This makes variable spreads riskier for traders who enter trades before high-impact events.

Factors That Influence Spreads

Several factors affect the size of spreads in forex and other markets:

- Market Liquidity: Highly liquid assets like major currency pairs (EUR/USD, GBP/USD) have lower spreads, while exotic pairs or illiquid stocks have higher spreads.

- Volatility: Increased volatility often results in wider spreads. Major news events can cause sudden price movements, leading to costlier trades.

- Time of Day: Spreads tend to be narrower during peak trading hours (London and New York sessions) and wider during low-activity periods (Asian session close).

- Broker Type: Market maker brokers typically offer fixed spreads, while ECN/STP brokers provide variable spreads based on real market conditions.

- Economic Events: Interest rate decisions, inflation reports, and geopolitical developments can significantly impact spreads.

Use Case: A trader specializing in trading the Non-Farm Payroll (NFP) report must be cautious, as spreads tend to spike during the minutes before and after the announcement. A spread that is normally 1 pip could jump to 6-8 pips, making it harder to execute trades at the desired price.

How to Identify and Calculate Spreads

Most trading platforms display spreads in real time. Traders can use the following methods to identify and calculate spreads:

- Price Quotes: By checking the bid and ask prices on a trading platform, the spread can be calculated as:

Spread = Ask Price – Bid Price - Economic Calendars: Monitoring scheduled events can help predict when spreads might widen.

- Trading Software: Some platforms provide spread indicators to visualize fluctuations over time.

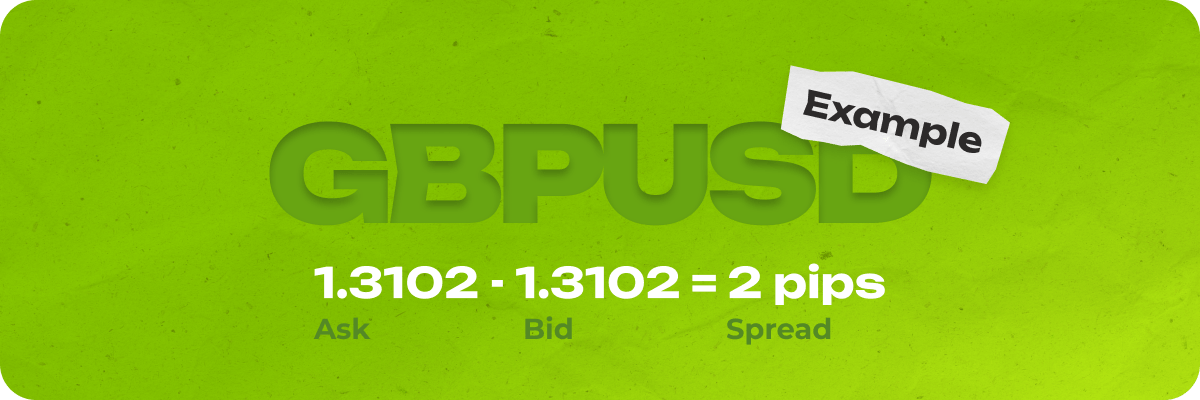

Example: If GBP/USD has a bid price of 1.3100 and an ask price of 1.3102, the spread is 2 pips. If the spread suddenly increases to 5 pips, it indicates lower liquidity or higher volatility. Scalpers monitoring these fluctuations can adjust their strategies accordingly.

Choosing the Right Spread for Your Trading Style

Different trading strategies require different types of spreads. Here’s how spreads impact various trading styles:

- Scalping: Traders who make multiple trades within minutes benefit from low, variable spreads to reduce costs.

- Day Trading: Both fixed and variable spreads can work, depending on the market conditions and trading volume.

- Swing Trading: Spreads have a smaller impact on swing traders who hold positions for days, making fixed spreads a viable option.

- News Trading: Due to extreme volatility, traders must be cautious about widening during major announcements.

Example: A scalper trading EUR/USD with a spread of 0.5 pips can enter and exit positions quickly, while a swing trader holding a trade for several days might not be affected by minor spread fluctuations.

Conclusion

Spreads play a crucial role in trading, affecting the cost and profitability of every trade. Understanding the difference between fixed and variable spreads helps traders choose the right approach based on their strategy and risk tolerance.

While fixed spreads offer predictability, variable spreads reflect market conditions, providing better pricing opportunities in liquid markets.

By keeping an eye on economic events, market liquidity, and time of day, traders can minimize spread-related risks and enhance their trading performance.