Financial markets provide opportunities to grow wealth, but success requires preparation and strategy. Online trading platforms have made market access easier, yet many beginners fail due to lack of planning and emotional trading. To increase your chances of success, a structured approach is essential.

This guide explains how to start trading effectively, from selecting a trading platform to risk management and strategy development. Whether you’re interested in stocks, forex, or other assets, this resource will help you make informed decisions.

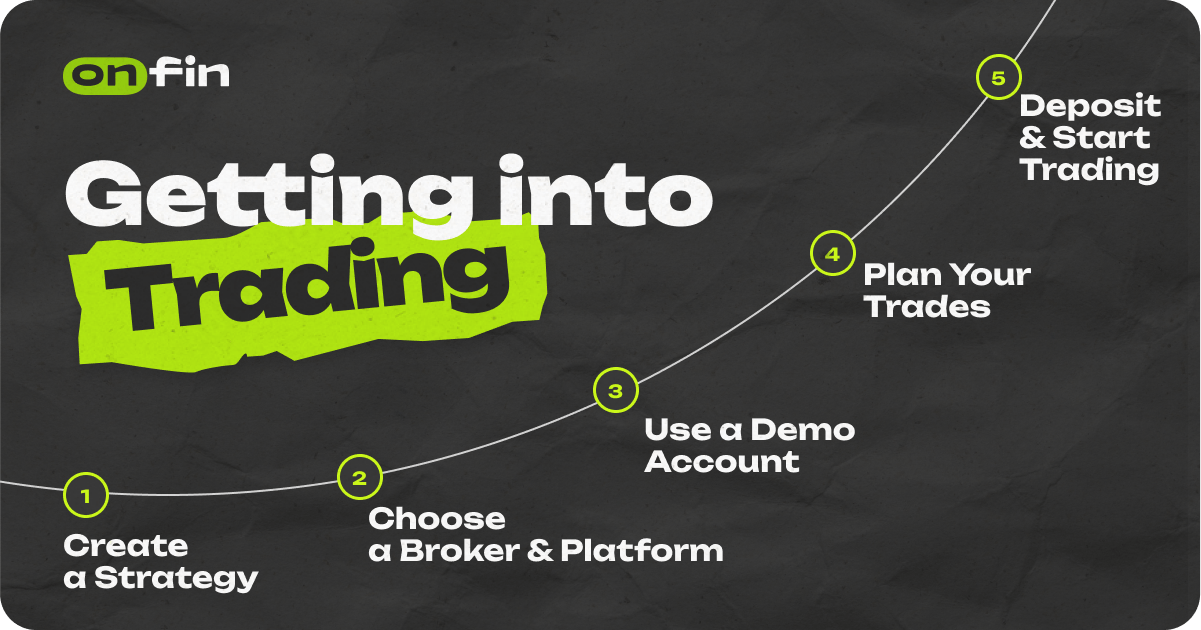

Key Steps to Start Trading

It is important to develop a trading strategy, select a reliable broker, and practice and develop a trading plan first because these steps create a strong foundation for successful trading.

A well-crafted strategy helps define your goals and risk management techniques, ensuring that every trade aligns with your overall objectives.

Choosing a reliable broker is equally essential because a trustworthy broker provides a stable, secure trading environment, access to the necessary tools, and fair execution of trades. Without a solid broker, even the best strategy can fail due to unreliable service or hidden costs.

Practicing with a trading plan allows you to refine your skills without risking real money initially. It helps you understand market conditions, test different strategies, and learn how to react under pressure. The process of practicing enables you to build confidence, identify your strengths and weaknesses, and adjust your approach accordingly.

It all helps you set yourself up for better decision-making, controlled risks, and a more disciplined trading approach, ultimately increasing your chances of long-term success.

1. Build a Trading Strategy

Entering the market without a clear plan often leads to losses. A trading strategy defines your approach, helping you determine when to enter and exit trades, manage risks, and select assets. Common strategies include:

- Day Trading. Short-term trading where positions are opened and closed within the same day. This strategy requires quick decision-making, strong analytical skills, and the ability to monitor the market closely. Traders often rely on technical indicators and chart patterns to identify profitable opportunities.

- Swing Trading. Holding positions for several days or weeks to capture market trends. Swing traders focus on medium-term price movements and use both technical and fundamental analysis to make informed trading decisions.

- Scalping. Making multiple quick trades to profit from minor price changes. Scalping requires a fast-paced approach, high liquidity assets, and a deep understanding of price action and market microstructures.

- Position Trading. Long-term investing based on fundamental analysis. Position traders focus on the overall trend of an asset and may hold positions for months or even years, making them less sensitive to short-term market fluctuations.

Choosing the right strategy depends on your financial goals, risk tolerance, and market preference.

2. Select a Reliable Broker and Trading Platform

A trading platform is your gateway to the markets, and selecting a reputable broker is crucial for a smooth experience. Key factors to consider:

- Regulation. Ensure the broker is licensed by a recognized authority. Regulatory oversight helps protect traders from fraudulent activities and ensures fair market practices.

- Available Assets. Look for a diverse range of trading options such as stocks, forex, cryptocurrencies, indices, and commodities. Diversification helps manage risk and enhances profit potential.

- Costs and Fees. Compare spreads, commissions, and leverage terms. High transaction fees can eat into profits, so choosing a cost-effective broker is essential for long-term success.

- Educational Support. Some brokers offer tutorials, webinars, and analysis tools. Access to learning resources can help beginners develop trading skills and understand market dynamics.

- Payment Methods. Check deposit and withdrawal options for convenience and security. Fast and secure transactions ensure a smooth trading experience without unnecessary delays.

A good trading platform should provide essential tools such as live charts, technical indicators, and news updates.

3. Practice with a Demo Account

Before investing real money, practicing in a risk-free environment is crucial. Many brokers offer demo accounts, allowing you to learn how to use the trading platform effectively, including order placement, charting tools, and risk management features.

Beginners get a chance to test different strategies without financial loss. It helps traders understand which approaches work best for them. What’s more, they may gain confidence before entering real trades, reducing the possibility of costly mistakes due to inexperience.

This step helps develop trading discipline and improve decision-making.

4. Develop a Trading Plan

A structured plan reduces impulsive decisions and enhances consistency. Your trading plan should include several crucial points.

The first one involves entry and exit criteria. The idea is to define when to open and close trades based on market conditions and technical indicators.

The second crucial point considers following risk management rules. It means, one needs to use stop-loss and take-profit levels to protect capital and lock in profits.

Capital allocation allows setting position sizes to control risk exposure and prevent overleveraging while market research routine keeps traders informed about news and economic events that may affect prices, ensuring well-informed trading decisions.

5. Fund Your Account and Start Trading

Once confident with your strategy, you can fund your account and begin trading. Before placing your first trade:

- Ensure account verification for seamless transactions and compliance with regulatory requirements.

- Start with a small amount to manage risk effectively and gradually increase your investment as you gain experience.

- Follow your trading plan and avoid impulsive decisions driven by emotions or market hype.

Core Trading Concepts

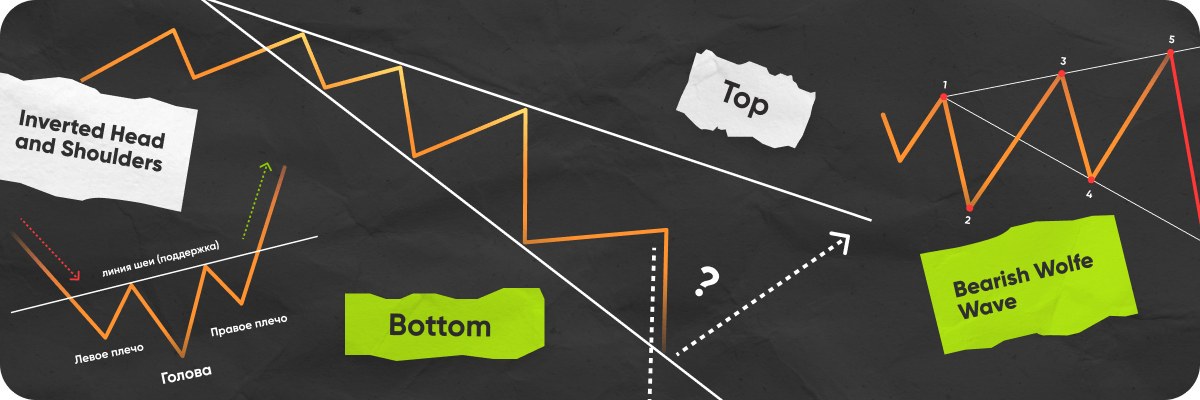

Market Analysis: Technical vs. Fundamental

Traders use different methods to analyze price movements:

- Technical Analysis. Involves studying charts and indicators like moving averages, RSI, Bollinger Bands, and Fibonacci retracements to predict price trends. Traders look for patterns and trends to identify entry and exit points.

- Fundamental Analysis. Examines economic data, company performance, interest rates, geopolitical events, and other macroeconomic factors to determine an asset’s intrinsic value. This approach is more suitable for long-term investors.

Risk Management: Protecting Your Capital

Effective risk management is essential for long-term success. Key techniques include:

- Stop-Loss Orders are used to automatically close trades at a predefined level to prevent excessive losses and protect trading capital.

- 1-2% Rule means avoiding risking more than 1-2% of capital on a single trade to ensure sustainability.

- Diversification supposes spreading investments across different assets and markets to reduce overall risk and improve portfolio stability.

- Leverage Control is crucial. While leverage can boost profits, it also increases potential losses. Use leverage conservatively to avoid excessive risk exposure.

Trading Psychology: Managing Emotions

Emotional discipline plays a vital role in trading. Common pitfalls include fear, greed, and overtrading. To stay focused, you need to stick to the trading plan whatever happens despite market fluctuations. If you can avoid emotional decision-making, you will be able to succeed.

Another factor is to avoid revenge trading after losses. Also known as chasing the loss, it often leads to greater financial setbacks. Take breaks to maintain a clear mindset and prevent burnout, ensuring rational decision-making.

The Bottom Line

Trading can be profitable, but it requires patience, discipline, and continuous learning. Selecting a good trading platform, following a solid strategy, and practicing effective risk management will improve your chances of success.

With this guide, beginners can avoid common mistakes like excessive leverage and emotional trading while refining your skills through education and research.

FAQ

How much capital is needed to start trading?

Investment requirements vary by broker and asset. Some brokers allow trading with as little as $100, but a larger deposit provides better risk management options and flexibility in trade execution.

Can beginners trade without experience?

Yes, but it’s advisable to start with a demo account and learn key concepts like market analysis and risk management before using real money. Education and practice significantly improve trading performance.

What is leverage and should beginners use it?

Leverage allows traders to control larger positions with less capital. While it can increase profits, it also magnifies losses. Beginners should use low leverage ratios and fully understand its risks before applying it.

How do I select the best trading strategy?

Choose a strategy that aligns with your financial goals, risk tolerance, and available time. Active traders may prefer day trading, while long-term investors may opt for position trading.

Which market is best for beginners?

Forex and stocks are popular due to their liquidity and educational resources. However, other markets like commodities and cryptocurrencies also offer opportunities for those willing to learn.

By following these steps and continuously improving, new traders can build a solid foundation and increase their chances of success in financial markets.