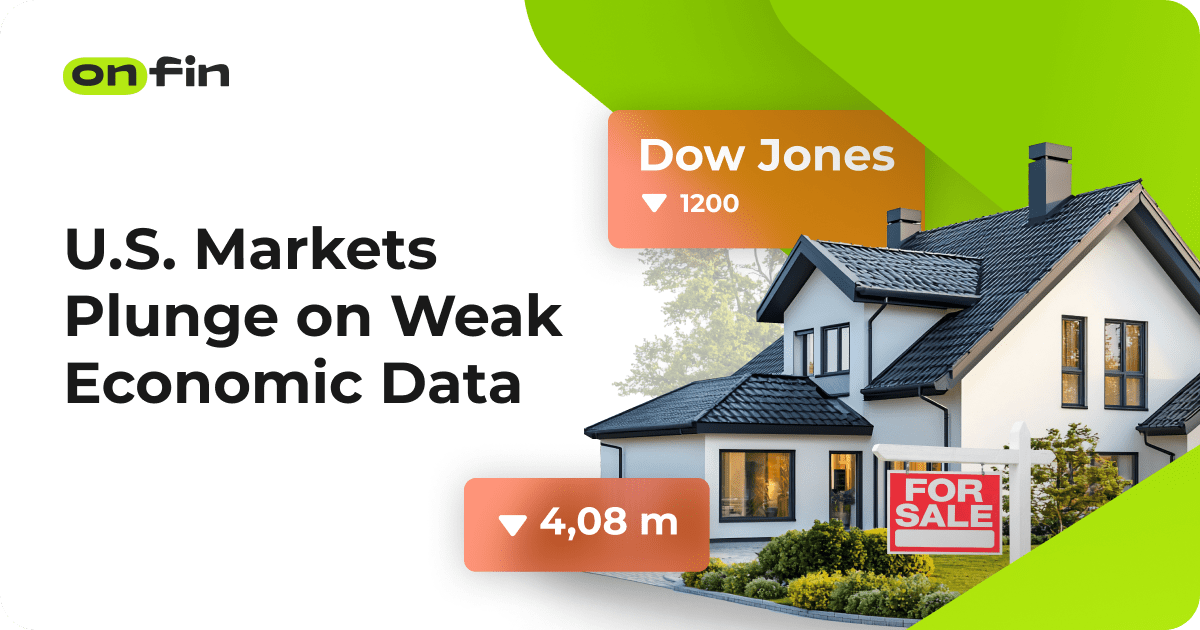

On Friday, U.S. stock markets suffered their biggest drop of 2025, just two days after the S&P 500 hit a record high. The Dow Jones Industrial Average tumbled more than 700 points, bringing its total losses over two days to 1,200 points, according to Business Insider. The sharp decline was triggered by a wave of negative economic data, which raised concerns about the health of the U.S. economy and the future of Federal Reserve policy.

Key Economic Reports Spark Sell-Off

The sell-off intensified following the release of three major economic reports at the start of the trading session. The data painted a bleak picture of consumer confidence, real estate, and business activity:

- Consumer Confidence Decline – The Consumer Confidence Index fell for the second consecutive month in February, hitting its lowest level since November 2023. This signals growing uncertainty among consumers about economic stability.

- Weak Housing Market – Sales of existing homes dropped to 4.08 million units in January, falling well short of analysts’ expectations of 4.29 million. This decline reflects higher mortgage rates and worsening affordability in the housing market.

- Business Activity Slump – The Services PMI (Purchasing Managers’ Index) for February slipped to 49.7 points, missing forecasts of 52.9 and falling below December’s 52.8 reading. A number below 50 indicates a contraction in the services sector.

Investor Anxiety Grows Over Economic Slowdown

These disappointing figures have raised alarms among investors, as they suggest a deteriorating economic outlook. The weak consumer confidence report indicates lower spending, which is a key driver of U.S. economic growth. Meanwhile, the slowdown in the housing market signals higher borrowing costs and affordability issues, further straining household budgets.

Additionally, the unexpected contraction in the services sector—a pillar of the U.S. economy—adds to worries that economic momentum is fading. Many traders fear that if this trend continues, it could negatively impact corporate earnings, leading to further market volatility in the coming months.

Federal Reserve’s Interest Rate Policy in Focus

Concerns over the Federal Reserve’s monetary policy have further fueled uncertainty. Investors had been hoping for interest rate cuts in the first half of 2025, but the Fed has been reluctant to ease policy too quickly. With inflation risks still present, the central bank has signaled that it may keep rates higher for longer, aiming to stabilize the economy before making any adjustments.

According to market analysts, the latest economic data could complicate the Fed’s decision-making process. If the economy continues to weaken, the central bank may face growing pressure to lower interest rates. However, officials remain concerned about inflation, which means any policy shifts are likely to be gradual and cautious.

Market Reaction and Outlook

The sharp decline in stocks has left investors on edge, with many shifting their focus to upcoming economic reports for further clarity. Analysts are closely watching inflation figures, job market data, and corporate earnings reports to gauge the strength of the economy.

Despite the market turmoil, some experts believe that long-term investors could see buying opportunities if the sell-off continues. Others warn that volatility may persist, especially if the Fed maintains its current stance on interest rates.

As the economic landscape remains uncertain, traders and policymakers alike will be monitoring developments closely. The coming weeks will be crucial in determining whether this market decline is a short-term reaction or the start of a broader downturn.